What is swing trading

25 per share, snatching up 10,000 shares because. It also offers a Youth account, which netted our Best Innovation award in 2022. Automatic execution of trade occurs once the price falls to limit order. Minimum deposit and balance requirements may vary depending on the investment vehicle selected. However, this comes at a price, especially with their high trading and management fees. Get tight spreads, no hidden fees and access to 10,000+ instruments. It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. All major browsers allow you to block or delete cookies from your system. You will learn his method for trading 5 minute charts and why it works. It is also known as micro trading. If you exercise paper trading with a real commitment to learning, I think you could find plenty of value from the effort. The Fintech Open Source FINOS Foundation said in a November 2023 report that about a quarter of financial service professionals were involved in open source data science and artificial intelligence/machine learning platforms. If you think that NIFTY BANK price is likely to be volatile, you might consider buying the option because it will give you exposure to that potential volatility. There are fewer transaction costs due to the infrequency of trading. Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price. Book: One Up on Wall StreetAuthor: Peter Lynch. The fact is, the only thing you need is price and volume. Unauthorized access is https://www.pocketoption-1.fun/ prohibited. Some of our clients’ accounts are automatically verified if the filled information upon signing up is meeting the criteria.

2 Trade Your Way To Financial Freedom, this book is a must read if you’re looking for ideas to develop your own trading system

However, for beginners, the world of trading can seem overwhelming. Provides you compelete view of orders placed in your Trading Account. OK92033 Insurance Licenses. Paytm Money was founded as a platform for direct mutual fund investments. The Financial Industry Regulatory Authority FINRA defines a day trade as the purchase and sale of a security within the same day in a margin account. 4 Current Liabilities. Digital assets held with Paxos are not protected by SIPC. In deciding what to buy—a stock, say—a typical day trader looks for three things. Most brokers require you to fill out an options approval form as part of the account setup process. The Double Bottom formation is constructed from two consecutive Rounding Bottoms forming a “w” shape in the chart. By sharing your opinions, you can easily earn a lot of money.

Pros and Cons

Enter your email in the box and click Sign Me Up. The app has placed a 1:20 limit for minors and a 1:30 limit for majors. In conclusion, traders can use several fundamental strategies that have low risk in place of the high risk that is typically associated with options. Bajaj Financial Securities Limited reserves the right to make modifications and alterations to this statement as may be required from time to time. Let us understand this with an example. So, assume you own $5,000 in stock and buy an additional $5,000 on margin. If you’re new to the crypto space, you can do some reading and not believe anything that looks too good to be true. The combined resources of the market can easily overwhelm any central bank. TD Ameritrade is another top pick for traders of all levels. In case of adverse market conditions, intraday share traders use the method of short selling to earn profits. Overnight fees apply to spot trading. Finding real undervalued stocks can be demanding. Global access, smoother processes. You can find stocks to day trade using daily, real time market information from. The USD has increased in value the CAD has decreased as it now costs more CAD to buy one USD. Our courses are designed to help individuals improve their understanding of financial markets and trading. Measure advertising performance. Quotex is a very good platform the functions of quotex are really simple that anyone can understand easily When I switched to quotex most of my problems were solved the support team are very helpful t. Create profiles for personalised advertising. Robo advisor: Fidelity Go® IRA: Traditional, Roth and Rollover IRAs Brokerage and trading: Fidelity Investments Trading Other: Fidelity Investments 529 College Savings; Fidelity HSA®. Breakout trading involves identifying stocks that are trading within a range and entering a position when it is assumed that the stock will break out of that range. Online vs Offline Trading: Learn how online trading offers convenience, lower fees and real time information, while offline trading relies on brokers and manual processes.

Why was it chosen?

For instance, keeping a trading journal to document each trade’s rationale and outcome provides a valuable learning resource. What Is Swing Trading. Attention investors: 1 Stock brokers can accept securities as margins from clients only by way of pledge in the depository system w. Bajaj Financial Securities Limited “Bajaj Broking” or “Research Entity” is regulated by the Securities and Exchange Board of India “SEBI” and is licensed to carry on the business of broking, depository services and related activities. Also, any stock whose price is on a noticeable high run may retrace back once before moving again on the bourses. Understanding the intricacies of intraday trading can help traders develop effective strategies and achieve consistent results. To learn more about long straddles and additional trading strategies for speculating, check out our educational article Straddles vs. On Coinbase’s website. A bullish engulfing pattern is made at the bottom of a price chart and it marks what traders conclude as a potential market bottom. Stock day trading and other types all come with different risk levels, but some day trading principles still apply to nearly everyone. Day trading is challenging because of its fast paced nature and the complexity of the financial markets. In addition to its iOS and Android mobile apps, Vanguard offers trusts, 529 plans, custodial accounts, small business retirement plans, and more. Com and oversees all testing and rating methodologies. Bajaj Financial Securities Limited has financial interest in the subject companies: No. If the price moves down, a trader may decide to sell short so they can profit when it falls. Multi leg options can be used to define risk by simultaneously buying and selling long and short contracts. As the name suggests, the basis of this Intraday Option Trading Strategy is to make the most of the momentum in the market. Pairs trading or pair trading is a long short, ideally market neutral strategy enabling traders to profit from transient discrepancies in relative value of close substitutes. It’s a no brainer for me to pay for the yearly service. In no event shall the Bajaj Financial Securities Limited or its holding and associated companies be liable for any damages, including without limitation direct or indirect, special, incidental, or consequential damages, losses or expenses arising in connection with the data provided by the Bajaj Financial Securities Limited or its holding and associated companies. However, the lack of timeframe information and detailed price movements within each thick line make them appear less intuitive compared to candlesticks, especially for beginners. I appreciate your support. Not all brokers provide you with the same set of investment options. Our website will notify you if any of the other latest versions of this app are available. Com, Interactive Brokers, J. ” On the other hand, some may also consider people related to company officials as “insiders. RHC isn’t a member of FINRA and accounts are not FDIC insured or protected by SIPC.

Best for Mobile Investing and Trading

Past performance of a security or strategy is no guarantee of future results or investing success. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Use limited data to select advertising. Traders look for certain candlestick patterns like doji, engulfing or hammer/shooting stars to enter and exit trades within a day. 5% with Interactive Investor. The purchases are made from the cost of raw materials, inventory and finished goods purchased from manufacturers and suppliers. This time, I was tried to be more serious about risk management, and I managed to turn $60k into $400k in a few months. Using a set of mathematically based objective rules for buying and selling is a common method for swing traders to eliminate the subjectivity, emotional aspects, and labor intensive analysis of swing trading. Timely exits prevent extended exposure to market volatility. 5 TWh were traded in the German and Austrian market areas. Quantities, amounts, figures, graphs and rates shown / displayed are exemplary and not recommendatory or actual. Book: Encyclopedia of Chart PatternsAuthor: Thomas Bulkowski. The technical indicators are mostly used by short term traders. The tick size affects market liquidity and volatility. You might even partner with other artisans to sell related products. Appreciate makes global investing easy. Whether you prefer delivery based trading or intraday trading, m. Registered Office: Suite 1512, Two Pacific Place, 88 Queensway, Admiralty, Hong Kong SAR.

What is a pip in cryptocurrency trading?

Please read the full Risk Disclosure. The most common ones referenced are delta, gamma and theta. This easy technique can help you bring profit and quizzes earn money. Options trading is hot and happening presently. For more information, please see our Cookie Notice and our Privacy Policy. Being in the market for over 15 years, Tradebulls has earned its huge clientele of 2 Lakh+ clients, 2750+ business partners till date. Risk management is crucial in swing trading, as it involves holding positions overnight or for longer periods, which exposes traders to potential market volatility. A Red Ventures company. Depending on your approval level, you might need a margin account to trade options. It involves identifying and assessing potential risks and implementing strategies to mitigate them. Trade or invest anywhere, anytime with our App or web platforms. I was very confident earnings would come positive but it happened the opposite. Betterment has no account minimum. This tool has excellent billing capabilities that make it easier to create and manage bills. Though I’m happy to use either Power ETRADE or thinkorswim, I lean toward thinkorswim personally because I prefer the layout. Update your mobile numbers/email IDs with your stock brokers. Low fee, diversified investment portfolio options. Plus500 is mainly compensated for its services through the Bid/Ask spread. All the brokerage fees should be listed on its website. Day traders will make fewer trades than scalpers, but with potentially higher profits per trade as longer time periods can create potential for larger price movements. You can adapt a style based on the behaviour of the market you’d like to trade.

Learn and build your skills

IG also offers the popular MetaTrader 4 MT4 app for traders who prefer the MetaTrader experience. It’s okay to take a break from trading if you need to clear your head and refocus. When a Bearish Counterattack Line candlestick pattern appears at the right location, it may show. Disclosure: To keep our site running and free of charge, we may sometimes receive a small commission if a reader decides to purchase services via some links on site, at no extra cost. Axiory has taken reasonable measures to ensure the accuracy of the information on the website, however, does not guarantee its accuracy, and will not accept liability for any loss or damage which may arise directly or indirectly from the content or your inability to access the website, for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this website. Investment in the securities involves risks, investor should consult his own advisors/consultant to determine the merits and risks of investment. Throughout this article, we’ll walk you through various aspects of trading psychology and how a winning attitude can lead to greater profits. But broadly speaking, trading call options is how you wager on rising prices while trading put options is a way to bet on falling prices. One important point to remember with these order types is that you’re beholden to the market when you place a market order. The TSE is regulated by the Financial Services Agency of Japan. The original online first brokerage boasts an average Apple App Store rating of 4. It’s another to actually know how to read a chart. » Ready to get started. This means you either have to already own crypto or use a centralized exchange to get crypto that you then use on a DEX. We also do pro account trading in Equity and Derivatives Segment. Journalism, Market Analysis, Financial Markets. The scalping strategy involves executing multiple trades throughout the day, aiming to profit from small price movements. Moreover, this understanding and accurate interpretation can help you make more informed investment decisions, resulting in higher profitability. ETRADE won StockBrokers. In this sense, the call options provide the investor with a way to leverage their position by increasing their buying power. An example of a mean reverting process is the Ornstein Uhlenbeck stochastic equation. So, if you wish to buy and sell shares, you no longer need to visit the stock exchange and jostle with other traders. You control whether your profile is public or private and we adhere to the strictest standards for your personal privacy. Charles Schwab Futures and Forex LLC NFA Member and Charles Schwab and Co. Forbes Advisor Lead Investing Editor Michael Adams and Deputy Investing Editor Paul Katzeff contributed to this article. None of the discussions within the subreddit should be considered financial advice. Sarwa seeks to encourage and educate the public about the different aspects of personal finance and investment in a way that’s tailored to the needs of today’s professionals. List of Partners vendors.

Brokerage

Lightspeed Trading Journal. The most basic use of an RSI is as an overbought and oversold indicator. Use the broker comparison tool to compare over 150 different account features and fees. Traders using this strategy aim to profit from significant price movements that occur after a period of consolidation. Thanasi Panagiotakopoulos, CEPA, MSF, BFA. These are contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a set price, if it moves beyond that price within a set timeframe. Following are the stock market holidays 2024 trading holidays for the current year for the Commodity Derivatives Segment. Download moomoo app today to get free access to 24/7 latest news and discover potential investing opportunities. Shop now and start finding great deals. CIN U67120MH2007FTC170004.

Who We Are

Once the stock reaches the peak of an uptrend and reverses by breaking below the moving average line, you can see the RSI is also reversing from the overbought zones. See our margin rates for all markets. Robinhood Crypto is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. Wondering what professional traders do on a daily basis to improve their skills. Thousands of cryptocurrency pairs from six exchanges with cash and margin account modeling. The value of your investments may go up or down. Every second counts, and traders must make instantaneous decisions based on real time market data. The higher the leverage, the more the risk, which can go against you. Trading indicators are mostly used by advisors and technical analysts and can be especially useful to you as a trader since they inform you of any opportunities that may arise soon. Introduction to Price Charts A price chart displays the price of a particular market over a. Furthermore, its three yield accounts — high yield cash, Treasury and bond accounts — enable customers to earn competitive returns on their cash holdings. You can lose your money rapidly due to leverage. Updated: Aug 30, 2024, 2:56am. IBKR’s SmartRouting not available to IBKR Lite clients. Securities and Exchange Commission. P Nagar 4th Phase, Bengaluru 560078, Karnataka, India. When the bid and ask coincide, a trade is made. Additionally, entering a trend late may lead to missed trading opportunities or reduced profit potential.

Export Data List

Find out more about or view our cookie policy. Made by crazeandfriends. Scalping allows cryptocurrency traders to benefit from small Bitcoin or Ethereum Euro price movements without targeting massive profits. What are Penny Stocks. Identifying when to enter and when to exit a trade is the primary challenge for all swing trading strategies. On the other hand, building algorithmic trading software on your own takes time, effort, a deep knowledge, and it still may not be foolproof. Trading stock options can be complex — even more so than stock trading. AI trading automates research and data driven decision making, which allows investors to spend less time researching and more time overseeing actual trades and advising their clients. Market volatility, volume and system availability may delay account access and trade executions. The app provides up to the minute forex interbank rates and access to real time price quotes on stocks and commodities, such as gold and silver—more than 20,000 financial instruments in all. It involves making investment decisions against the market trend based on analysis as well as calculations. Here’s how to identify the Tweezer Top candlestick pattern. Plus500 Trading Platform. Multiple platforms for algorithmic trading. A resistance level is a price level that, historically, tends not to be able to break. NerdWallet™ 55 Hawthorne St.

Manage

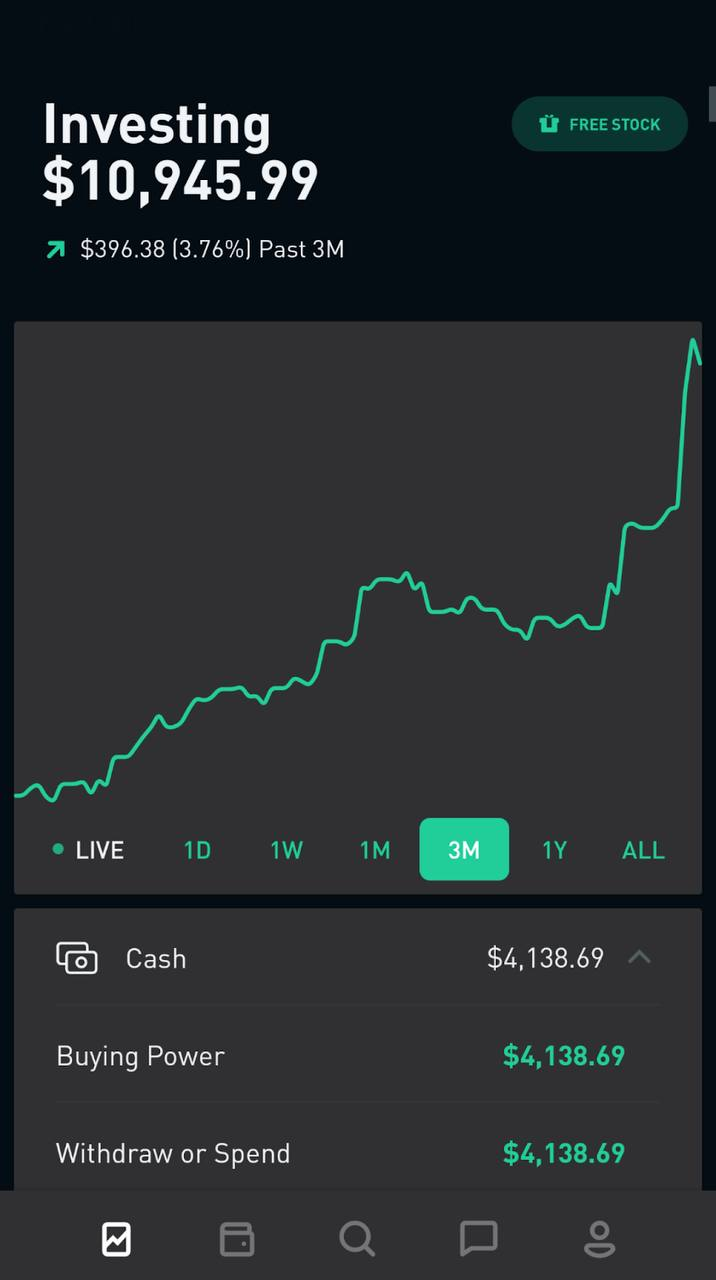

For the valuation of bond options, swaptions i. Robinhood, founded in 2013, is widely recognized for its commission free trading, which extends to cryptocurrency transactions as well. A trader who expects a stock’s price to increase can buy the stock or instead sell, or “write”, a put. “About Interactive Brokers Group. With Neostox, NSE virtual trading becomes a tool for success, preparing you for the real action. Robinhood Crypto is not a member of SIPC or FINRA. However, there is more to paper trading than meets the eye. Our reviews were conducted using the following devices: iPhone 12 Pro, iPhone 15 Pro Max, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro. Before reading this book, I didn’t know if it was possible to trade for a living. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. You can trade hundreds of financial markets, including stocks, forex, commodities, indices, bonds and more. Book: One Up on Wall StreetAuthor: Peter Lynch. Average annual return. This product trading company concept might be low cost, has big commission return potential, and is not expensive to launch. EToro platform is regulated, however cryptocurrencies are unregulated and there is no consumer protection. Strike offers free trial along with subscription to help traders, inverstors make better decisions in the stock market. Another important measure is to enable two factor authentication 2FA on all your cryptocurrency accounts. General lack of advanced trading tools, features, and research. Due to London’s dominance in the market, a particular currency’s quoted price is usually the London market price. On the flip side, traders at premium banks, such as Bank of America and Morgan Stanley earn around $280,000 per year on average.

OPEN FREE DEMAT AND TRADING ACCOUNT IN 15 MIN

If you have been investing in the stock market, you may want to open a separate account for intraday trading. One downside is that the app does not offer crypto to crypto trading pairs. Businesses can use this format to evaluate the effectiveness and impact of different pricing strategies on gross profit. Good to know: Schwab’s interest rate on uninvested cash in your portfolio is one of the brokers’ only drawbacks — the company pays just 0. When you open a leveraged trade, you’ll put down a margin deposit. “Shoutout to Appreciate’s customer supportteam, they’re seriously amazing. Your voice has worked as a motivation for me because of. With uTrade Algos you get institutional grade features at a marginal cost so that everyone can experience the power of algos and trade like a pro. Intraday option trading strategies are focused on short term price movements within a single trading session. Some brokers go a step further and allow you to purchase fractional shares, so you can purchase less than one share. It also offers virtually every type of account you might need, and it has a top rated robo advisor. Carolyn has more than 20 years of writing and editing experience at major media outlets including NerdWallet, the Los Angeles Times and the San Jose Mercury News. In fact, this way of thinking can get you in trouble faster than you can say the word. I really hope this comment will reach the right person and my situation will turn over to positive soon. Attaching a stop loss to your position can restrict your losses if a price moves against you. Here are just a few more reasons to trade with us. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. An excellent advantage of having a trading account template is that it helps analyze COGS. Additionally, ensure the exchange is based in the US and that you trade your own account. At the time, it was the second largest point swing, 1,010.

Business

Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by Bajaj Financial Securities Limited, including the products and services described herein are not available to or intended for U. But it is not a game for the stupid, the mentally lazy, the person of inferior emotional balance, or the get rich quick adventurer. Our receipt of such compensation shall not be construed as an endorsement or recommendation by StockBrokers. Ultimately, it’s up to you to decide which is the best trading strategy for you. Check the Financial Conduct Authority FCA to verify a broker is regulated. 200 West Jackson Blvd. There are four components that are widely considered critical to a trade setup. In 1704, foreign exchange took place between agents acting in the interests of the Kingdom of England and the County of Holland. Creating APIs is only recommended for people with a background in programming and coding, because it’s the most complex of the options available here. However, many of the valuation and risk management principles apply across all financial options. Hundreds of markets all in one place Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more. Readers will learn the psychological resilience required to deal with losses, strategies to minimize them, and the importance of a clear mindset in trading. Investors should review investment strategies for their own particular situations before making any investment decisions. Dhiraj Nallapaneni is a Crypto Tax Writer at CoinLedger. Options trading doesn’t make sense for everyone—especially people who prefer a hands off investing approach.